EA in FX Trading: Development, Pros, Cons, and Risks

The term “Expert Advisor (EA)” generally refers to a program operating on MT4 or MT5 platforms that can automatically execute preset trading strategies.

EA can help traders get rid of the burden of constantly monitoring the market and rely on the program to automatically analyze market conditions and automatically execute trades instead, which allows them to capture potential opportunities and profits.

This article will provide a detailed overview of the basic concepts, advantages, disadvantages, and important considerations of the use of EAs.

What is an Expert Advisor (EA) in FX Trading?

An Expert Advisor (EA) is a system that trades according to programmed strategies, it can automatically execute buy and sell decisions without manual intervention.

This trading approach has become more and more popular among traders, especially in the FX market.

How is an EA Developed?

The development of EA involves the design of both programming and trading strategies. EAs are often created for specific trading platforms such as MetaTrader 4 or MetaTrader 5, these platforms provide their own programming languages (MQL4 and MQL5, respectively) which support the development of EA. The basic steps for EA development are as follows:

1. Definition of Trading Strategy

First, you need a clear trading strategy which includes the conditions to trigger entries and exits, and risk management measures (such as the setting of stop-loss and take-profit).

This is the most critical step in the development process, because after all, the aim of programming work is just to translate the concerning strategy into executable program codes.

2.Learning MQL Programming

You need to understand the programming language that is used by the MetaTrader platform to develop an EA.

These programming languages are designed and dedicated to the development of trading strategies, which contain a lot of built-in functions to acquire market data, execute trading, and perform mathematical calculations.

3. Write the Program Code

Once you get the knowledge for the design of trading strategy and MQL programming, the next step is coding, which involves the definition of trading rules, setting of parameters (e.g., trade volume and the level for stop-loss and take-profit), and establishing the logic to process market data and trading signals.

4. Testing and Optimization

After the program codes are established, you need to perform backtesing on EA with historical data to evaluate its effectiveness.

The MetaTrader platform provides robust backtesting features which allow the test on how your EA performs under various market conditions.

You may need to adjust the parameters of your strategies or optimize the logic of program codes according to the results of backtesting.

5. Live Testing

After successful backtesting on historical data, you shall perform live testing through a demo account to evaluate the performance of EA under real-time market conditions, which helps identify potential issues that are not able to be recognized during backtesting.

6. Monitoring and Adjustment

A successful EA still requires continuous monitoring and periodic adjustments, which may involve modification of strategy parameters and update or optimization of program codes, after it is launched to adapt to market changes.

Features and Advantages of EA Trading

EA trading provides an efficient, objective, and systematic way to execute trading strategies, which is especially ideal for traders seeking to maximize opportunities while managing risks at the same time. Some examples of advantages and features of EA trading are as follows:

Programed Trading

EAs allow traders to design and execute trading strategies automatically, from market analysis to order management and including buy and sell and setting of stop-loss and take-profit, which improves the efficiency of trading and ensures consistency of trading decisions, while preventing emotional interference at the same time.

Rule-based Decision Making

EAs can avoid the impact of human weaknesses, such as fear and greed, on decision-making through automatic trading based on preset rules trading, which makes trading more objective and reasonable.

24/7 Trading

EAs can operate continuously, which can make fully benefit on the feature that FX trading runs 24 hours a day to ensure no trading opportunity is missed.

Quick Reaction and High-Frequency Trading

EAs can respond with ultra-fast speed and are ideal for high-frequency trading strategies that require rapid decision-making.

Strategy Testing and Verification

Backtesting allows traders to test the performance of EA strategies with historical data before launching the EA in real trading, which helps the evaluation of its potential and risk.

Risk Management

EAs can strictly obey preset risk management rules, such as fixed stop-loss and take-profit levels, which help traders control their losses and protect their profits.

Strategy Diversity

EAs support a wide range of trading strategies, from simple technical indicators to complex market analysis models, which offer various options for customization.

Risks and Disadvantages of EA Trading

Despite that EA trading can reduce emotional impact and increase efficiency by following preset rules, it still has limitations. In particular, it may be difficult for fixed algorithms to adapt in a real-time manner when faced with rapidly changing market conditions, which affects their performance. Some examples of risks and considerations in EA trading are as follows.

Sensitivity to Market Changes

Since EAs operate on fixed algorithms and rules, they may not be able to adapt to quickly changing market conditions or “black swan” events that rarely occur, which leads to failure of strategy.

Overdependent on Automation

If a trader relies on EAs too much, it may lead to ignorance of fundamental analysis of the market and other critical factors which is not covered by key non-algorithm.

Technical Risks

Technical risks include failures of software and/or hardware and network connection issues, all of which may influence the operation of EAs and execution of trading.

Slippage in Execution

In highly volatile markets, the difference between trade execution price and price preset in EAs, i.e. slippage, may exist and may leave a negative impact on trading results.

Over-optimization of Strategy

During backtesting, there is a risk of over-optimization with historical data, which makes the strategy perform well with the past data, but it may not produce equivalent results in future markets.

Ignorance of Psychological Factors

Although EAs rule out emotional influence, traders may therefore neglect self-education and cultivation of their feelings on the market, which reduces their ability to respond to unexpected market events.

Security Risks

Using unreliable EAs may lead to security issues, such as malware or viruses, which threaten the security of funds and personal information.

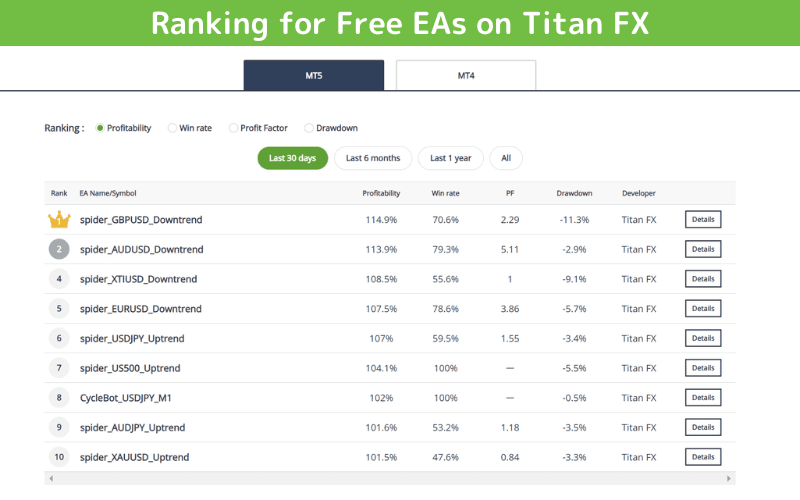

Titan FX provides dozens of EAs for MT4 and MT5 for free, and traders are allowed to review their past data before using them.