How to use MT5/MT4

The entities below are duly authorised to operate under the Titan FX brand and trademarks. Titan FX Limited (reg. No. 40313) regulated by the Vanuatu Financial Services Commission with its registered office at 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Goliath Trading Limited (licence no. SD138) regulated by the Financial Services Authority of Seychelles with its registered address at IMAD Complex, Office 12, 3rd Floor, Ile Du Port, Mahe, Seychelles. Titan Markets (licence no. GB20026097) regulated by the Financial Services Commission of Mauritius with its registered office at c/o Credentia International Management Ltd, The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. Atlantic Markets Limited (registration no.2080481) regulated by the Financial Services Commission of the British Virgin Islands with its registered address at Trinity Chambers, PO Box 4301, Road Town, Tortola, British Virgin Islands. The Head Office of Titan FX is at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The Titan FX Research Hub purpose is to provide solely informational and educational content to its users, and not investment, legal, financial, tax or any type of personalised advice. Opinions, forecasts, and any other information contained in this website do not constitute recommendations or solicitation to buy or sell financial instruments. Trading leveraged products like CFDs carries high risk and may not suit all investors. Users should conduct independent research or consult qualified professionals before making any trading decisions. While efforts are made to provide accurate information, no warranty is given for the completeness or suitability of the information contained in this website. Reliance on this content is at your own risk and Titan FX accepts no liability for loss or damage. This information is for residents of jurisdictions where Titan FX transactions are permitted.

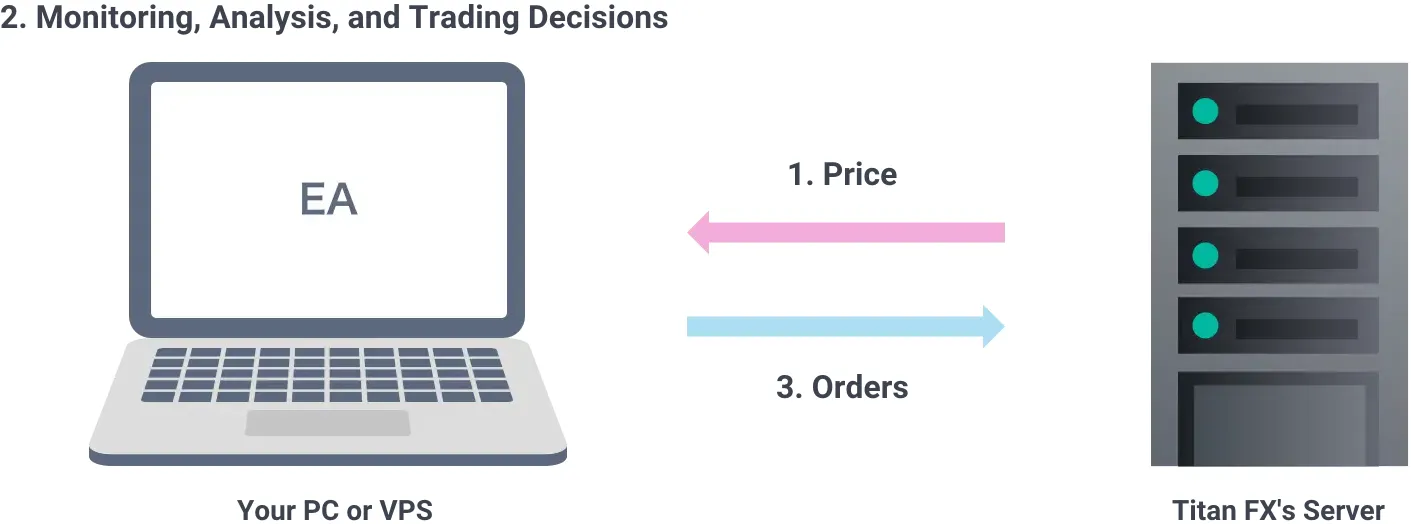

An Expert Advisor (EA) is an automated trading program that operates on the MetaTrader platform (MT4 or MT5). Once activated, the EA monitors and analyzes the movements of the forex market 24/7 on behalf of the trader and automatically executes trades based on a predefined trading strategy. By using an EA, traders can efficiently operate without the need to constantly monitor the market, thereby not missing any trading opportunities.

There are two main ways to obtain an EA: downloading from the internet or creating one yourself.

This involves purchasing EAs from MT4/MT5 dedicated marketplaces or acquiring those distributed by FX brokers. While the logic of these trades is often kept private, a significant advantage is that even those without programming skills can easily start automated trading. Titan FX also distributes numerous EAs that can be used for free.

For those interested, please visit here

Titan FX EA Rankings

Individuals with a trading strategy and knowledge of programming can create their own EAs using the MetaTrader language (MQL4 or MQL5). Although this is more complex, it allows for the advantage of automated trading using your original trading methods.

Since EA programs can be freely created, there are various types of EAs available. When operating with automated trading, it's important to choose which type of EA to use. Check the market conditions, frequency of trades, and content of trades to decide on the EA to operate.

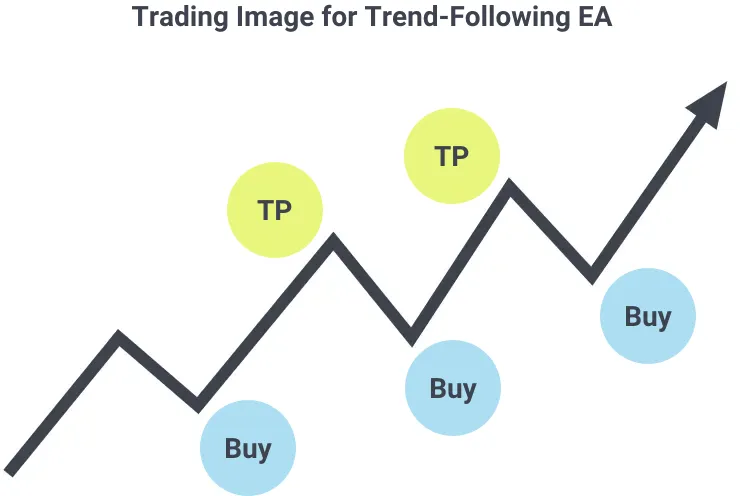

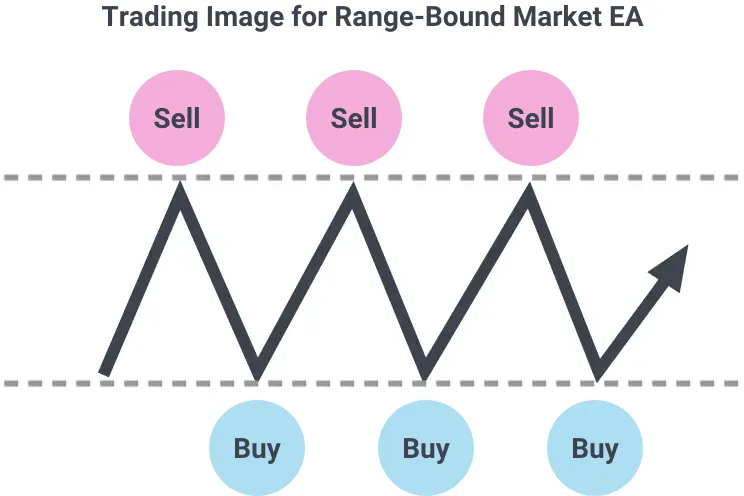

EAs have their preferred market conditions, like trend-following EAs (programs effective during rising or falling trends) or range-bound market EAs (programs effective in markets where prices move within a certain range). It's important to choose the most suitable EA while predicting the current and future market conditions.

Depending on the EA, there are programs designed for short-term trades as well as those intended for medium to long-term trades. Carefully consider the frequency at which you want to trade before making your choice.

It's also important to check the kind of trades an EA makes based on its backtesting (testing on historical price data) and forward testing (testing with small amounts or on a demo account) results. You can confirm the EA’s win rate, risk-reward ratio, maximum drawdown, etc., allowing you to envision how the EA would perform in actual operation.

| Win Rate | The number of winning trades compared to the total number of trades. The higher, the better, but caution is needed if the program has a low risk-reward ratio and one loss can lead to significant losses. |

|---|---|

| Risk-Reward Ratio | The average profit of winning trades compared to the average loss of losing trades. Higher is better, but be cautious if the win rate is too low. |

| Maximum Drawdown | The maximum percentage drop from the highest point of the account balance. The lower it is, the less the risk. |

| Profit Factor | Total Profit/Total Loss: If profitable, this will be above 1. The higher the number, the more profit is generated. |

| Recovery Factor | Total Profit/Maximum Drawdown: The higher the value, the less risk and the greater the tendency for returns. |

The benefits of using EAs include 1) improved time efficiency, 2) elimination of emotions, and 3) risk diversification. They compensate for the weaknesses of manual trading, which is why many traders are increasingly interested in automated trading.

The greatest advantage of using an automated trading system is the significant reduction in time traders spend monitoring the market. The FX market operates 24 hours, and it's extremely challenging for a human to constantly track market movements. However, an automated trading system overcomes this issue and continues trading even while the trader is asleep or engaged in other activities.

Automated trading systems operate based on preset rules, enabling consistent trading unaffected by the trader's emotions or instincts. Human traders are often influenced by fear or greed, deviating from planned strategies, but automated systems prevent these emotional errors.

Automated trading easily implements multiple strategies simultaneously. This maximizes trading opportunities under different market conditions and diversifies risk. It also enables equal distribution of exposure to market fluctuations, independent of specific markets or currency pairs.

| Drawbacks | Countermeasures |

|---|---|

| Difficulty in Responding to Sudden Market Changes Automated trading systems operate based on programmed parameters, making it challenging to respond to rapid market fluctuations or unexpected events. | Regularly review and adjust EA settings according to market conditions. Consider pausing automated trading during major economic news releases. |

| Difficulty in Risk Management Without proper risk management, automated trading could lead to significant losses. | Limit risk per trade and strictly adhere to capital management rules. Regular monitoring and adjustment of EA performance are also crucial. |

| System Failure Risks Technical issues such as software bugs or server downtime can impact the performance of automated trading. | Choose reliable EAs, ensure a quality internet connection, and have a power backup. Using a VPS (Virtual Private Server) contributes to stable system operation. |

In FX automated trading, a VPS (Virtual Private Server) is a service that virtually divides a server to provide individual server environments. This allows the FX automated trading system (Expert Advisor) to operate 24/7, even if the home PC is offline. VPS offers fast internet connections and low latency, enhancing the speed and efficiency of trading. High security and reliability protect the trading environment from external disturbances, enabling stable automated trading. It's an essential tool for FX traders to not miss market opportunities.

The benefits of using a VPS can be broadly divided into four major categories

Since the FX market is open 24 hours a day, 5 days a week, it's crucial for the trading system to be operational at all times to not miss market movements. Using a VPS ensures that the automated trading system continues to operate 24 hours, even if your home computer is shut down, thereby reducing the chance of missing opportunities.

VPS servers are typically housed in data centers that offer high-speed internet connections and low latency. This enables faster transmission of trade orders to the market than from a home PC. In FX trading, where milliseconds can make the difference between profit and loss, the fast connection of a VPS is a significant advantage.

VPS operations can be conducted from various operating systems. This includes not only Windows PCs but also Mac environments. Moreover, since access is possible from tablets and smartphones, you can check the real-time performance of your EA even while on the go.

ETo implement an EA, you first need to set up a trading account and download and install the MetaTrader platform. Then, choose your preferred EA and install it on the platform to start automated trading. Our website offers a variety of EAs and guides on how to set them up.

Prepare an account for automated trading. Create an account for either MT4 or MT5, depending on the EA you plan to use.

Install MT4 or MT5 on your PC or VPS. (Note: EAs only operate on a Windows PC.)

For detailed instructions on installing MT4 or MT5, please see here:

Install the EA on MT4 or MT5. For detailed instructions on installing and running EAs on MT4 or MT5, please see here

VPS is managed by professional data centers, with thorough data backup and security measures. This reduces the risk of trading interruptions due to hardware failures or security issues, as might happen with a home computer. Even if there are power or internet connectivity issues, a VPS operates independently, providing a stable trading environment.

These benefits make using a VPS an important element in realizing more efficient and stable trading in FX automated trading.