How to use MT5/MT4

The entities below are duly authorised to operate under the Titan FX brand and trademarks. Titan FX Limited (reg. No. 40313) regulated by the Vanuatu Financial Services Commission with its registered office at 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Goliath Trading Limited (licence no. SD138) regulated by the Financial Services Authority of Seychelles with its registered address at IMAD Complex, Office 12, 3rd Floor, Ile Du Port, Mahe, Seychelles. Titan Markets (licence no. GB20026097) regulated by the Financial Services Commission of Mauritius with its registered office at c/o Credentia International Management Ltd, The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. Atlantic Markets Limited (registration no.2080481) regulated by the Financial Services Commission of the British Virgin Islands with its registered address at Trinity Chambers, PO Box 4301, Road Town, Tortola, British Virgin Islands. The Head Office of Titan FX is at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The Titan FX Research Hub purpose is to provide solely informational and educational content to its users, and not investment, legal, financial, tax or any type of personalised advice. Opinions, forecasts, and any other information contained in this website do not constitute recommendations or solicitation to buy or sell financial instruments. Trading leveraged products like CFDs carries high risk and may not suit all investors. Users should conduct independent research or consult qualified professionals before making any trading decisions. While efforts are made to provide accurate information, no warranty is given for the completeness or suitability of the information contained in this website. Reliance on this content is at your own risk and Titan FX accepts no liability for loss or damage. This information is for residents of jurisdictions where Titan FX transactions are permitted.

The three primary classifications of crude oils in the world For the global economy today, crude oil is undeniably one of the most crucial commodities. It not only serves as the cornerstone of energy consumption worldwide, but also directly impacts the operation and development of the global economy.

Fluctuations in oil prices have far-reaching effects on inflation, industrial activities, and even national policies across the world.

Therefore, understanding and analyzing the global primary crude oil markets is crucial for every economist, policymaker, and investor.

This article will introduce and analyze the three primary classifications of crude oils: West Texas Intermediate (WTI), Brent Crude, and Dubai Crude.

These three classifications of crude oil are not only well-known for their abundant reserves and widespread use but also for their critical roles in global crude oil pricing mechanisms.

Through the discussion of these three crudes, our aim is to gain insight into the characteristics, background of origin, and how they influence the prices and economic policies of the global crude oil market.

West Texas Intermediate (WTI), also known as West Texas Crude, is a high-quality, light, sweet crude. The origin of WTI is primarily concentrated in the Permian Basin in Texas, the abundant oilfields here make the basin one of the major oil-producing regions in the world. WTI has become an important benchmark in the North American and global markets due to its outstanding quality and extensive market acceptance.

WTI is extracted from various oil fields in Texas and nearby areas.

The advantage of the location of these oilfields allows easy transportation of crude oil via pipelines to major refineries and export ports along the Gulf Coast of the United States.

Besides, WTI is also traded through Cushing, Oklahoma, a major oil trading hub, which strengthens its position as a pricing benchmark in North America.

WTI is known for its low sulfur content and high API gravity (indicating lower density), which make it easier to refine, producing a higher yield of light petroleum products, such as gasoline and diesel.

This makes WTI highly favored in global crude oil markets, especially for countries or regions with stringent environmental standards.

WTI prices are typically influenced by various factors, such as domestic productivity, pipeline capacity, political factors, and global demand for crude oil.

As one of the globally traded crudes with a larger trade volume, WTI prices are usually significantly affected by international political and economic events.

For instance, geopolitical tensions in the Middle East, OPEC production decisions, and shifts in U.S. energy policy can all have an immediate impact on WTI prices.

Besides, global economic trends, such as recession or rapid growth, can also significantly impact the demand and prices of crude oils.

Brent Crude is a light, sweet crude blended from crude oil sourced from multiple oil fields in the North Sea, including Brent, Forties, Oseberg, and Ekofisk fields.

Its quality and advantage in location of origin have made it a critical benchmark for the European and global oil markets.

Brent Crude is sourced from the North Sea, located between the United Kingdom and Norway.

This location of origin gives it strategic importance, as it can be easily transported to the major European refineries and other global markets.

Oilfields in the North Sea have been developed since the 1970s, and thus made Brent Crude become the most major oil source in Europe since then.

Brent Crude is a light, low-sulfur crude, making it extremely popular in global refining markets and is especially well-suited for producing gasoline and diesel.

The price of Brent Crude is typically influenced by production shifts in the North Sea, geopolitical events, global supply-demand dynamics, and international currency market fluctuations.

Due to its wide market acceptance and market liquidity, Brent Crude is often used as a global oil price benchmark.

Price of Brent Crude is highly sensitive to international political situations, especially events involving the region of the Middle East and other major oil-producing countries.

Changes in European political and economic dynamics, maritime transport security, and OPEC production policies all impact its pricing.

Besides, the status of global economics, such as economic growth or recession, also affects the demand and pricing of Brent Crude.

Dubai Crude, originating from the Middle East, particularly the Persian Gulf region in the Arabian Peninsula, is a crucial pricing benchmark for the Asian market.

Benefiting from its location of origin and chemical properties, Dubai Crude holds an important position in the global oil trade, and it has a particularly far-reaching influence on the Asian oil market.

Dubai Crude is primarily sourced from Dubai in the Arabian Peninsula. As the representative of Middle Eastern crude oil, Dubai Crude plays a crucial role as the pricing benchmark of regional export, although the production of oilfields in Dubai is lower than its neighboring countries, such as Saudi Arabia. The broad use of Dubai Crude in Asian refineries has made it an important pricing benchmark in Asia, especially for major oil importers like Japan, South Korea, and China.

Dubai Crude is a medium sour and medium density oil, making it relatively easy to process and especially suitable for producing diesel and fuel oil.

The price of Dubai Crude is influenced by global crude oil supply-demand dynamics, and the political and military events in the Middle East particularly have a considerable impact on it.

Besides, as the primary pricing benchmark for the Asian market, Dubai Crude pricing is also affected by economic conditions in Asian countries.

The price of Dubai Crude is highly sensitive to political stability in the Middle East. Geopolitical tensions, such as the Iranian nuclear issue, unstable conditions in Iraq and Syria, and production policies of Saudi Arabia, directly affect the market price of Dubai Crude.

Besides, due to its significance in the Asian market, economic growth data, energy demand, and supply chain dynamics in major Asian economies are also crucial factors that influence the price of Dubai Crude.

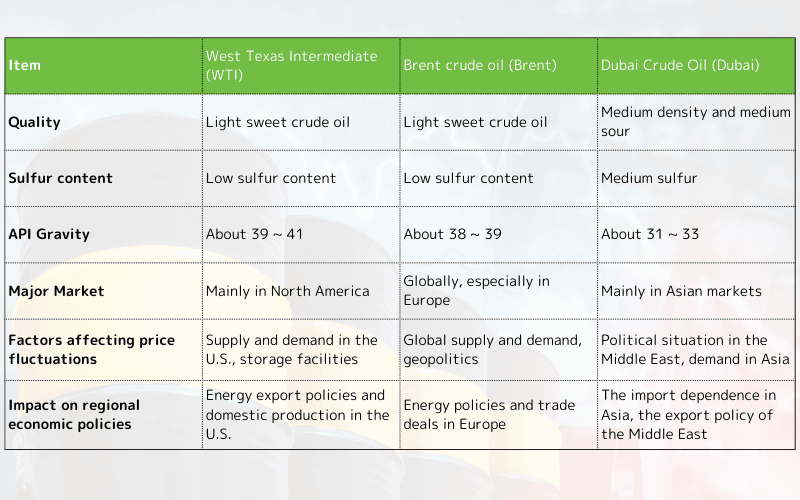

To better understand the key differences among the three major classifications of crude oils: West Texas Intermediate (WTI), Brent Crude, and Dubai Crude, please refer to the following comparison table, which highlights their characteristics in quality, sulfur content, API gravity, major markets, factors affecting price fluctuations, and impacts on regional economic policies.

| Item | WTI | Brent Crude | Dubai Crude |

|---|---|---|---|

| Quality | Light sweet crude oil | Light sweet crude oil | Medium density and medium sour |

| Sulfur content | Low sulfur content | Low sulfur content | Medium sulfur content |

| API Gravity | About 39 ~ 41 | About 38 ~ 39 | About 31 ~ 33 |

| Major Market | Mainly in North America | Globally, especially in Europe | Mainly in Asian markets |

| Factors affecting price fluctuations | Supply and demand in the U.S., storage facilities | Global supply and demand, geopolitics | Political situation in the Middle East, demand in Asia |

| Impacts on regional economic policies | Energy export policies and domestic production in the U.S. | Energy policies and trade deals in Europe | The import dependence in Asia, export policy of the Middle East |