How to use MT5/MT4

The entities below are duly authorised to operate under the Titan FX brand and trademarks. Titan FX Limited (reg. No. 40313) regulated by the Vanuatu Financial Services Commission with its registered office at 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Goliath Trading Limited (licence no. SD138) regulated by the Financial Services Authority of Seychelles with its registered address at IMAD Complex, Office 12, 3rd Floor, Ile Du Port, Mahe, Seychelles. Titan Markets (licence no. GB20026097) regulated by the Financial Services Commission of Mauritius with its registered office at c/o Credentia International Management Ltd, The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. Atlantic Markets Limited (registration no.2080481) regulated by the Financial Services Commission of the British Virgin Islands with its registered address at Trinity Chambers, PO Box 4301, Road Town, Tortola, British Virgin Islands. The Head Office of Titan FX is at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The Titan FX Research Hub purpose is to provide solely informational and educational content to its users, and not investment, legal, financial, tax or any type of personalised advice. Opinions, forecasts, and any other information contained in this website do not constitute recommendations or solicitation to buy or sell financial instruments. Trading leveraged products like CFDs carries high risk and may not suit all investors. Users should conduct independent research or consult qualified professionals before making any trading decisions. While efforts are made to provide accurate information, no warranty is given for the completeness or suitability of the information contained in this website. Reliance on this content is at your own risk and Titan FX accepts no liability for loss or damage. This information is for residents of jurisdictions where Titan FX transactions are permitted.

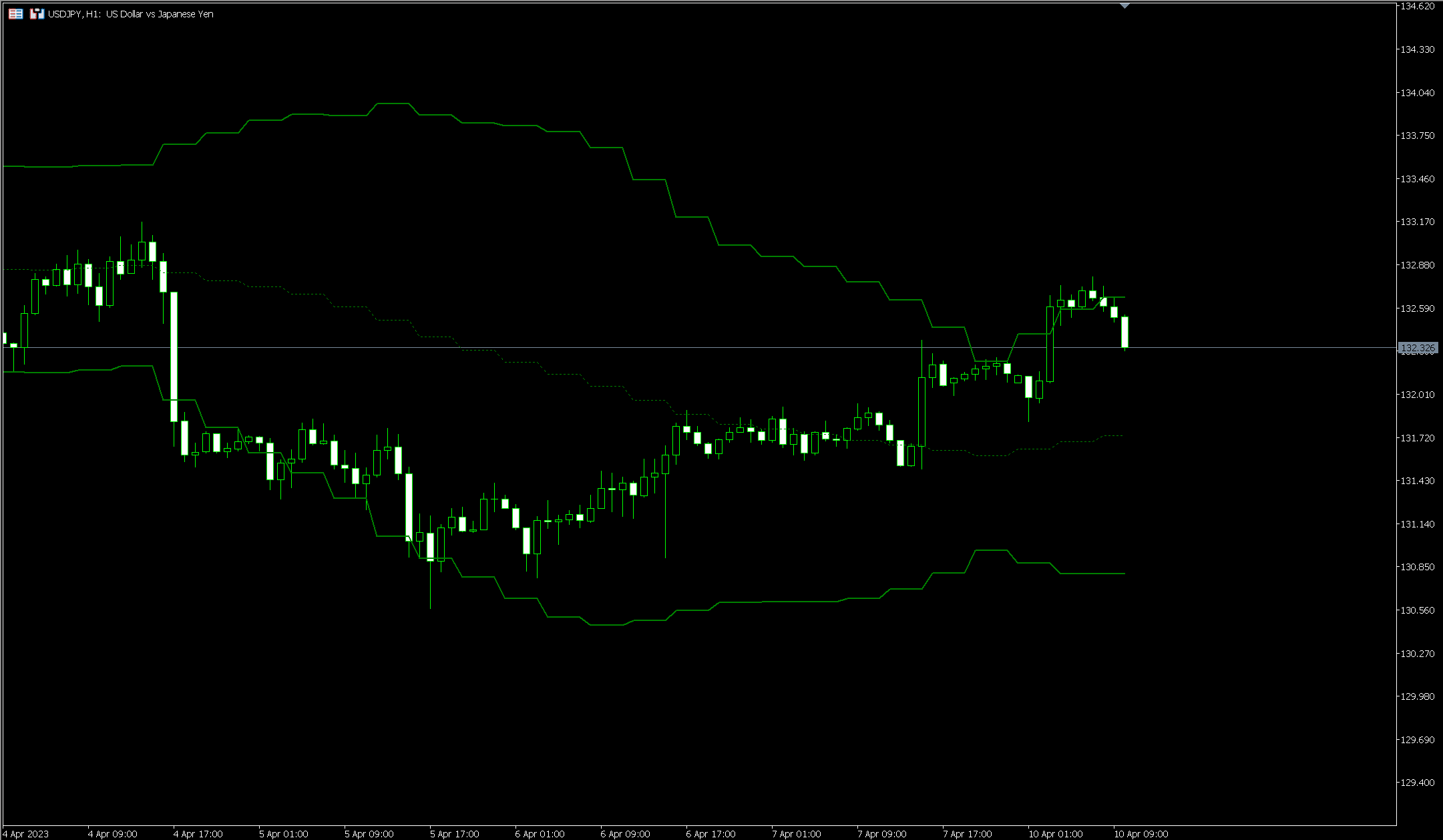

The Multi-Timeframe Bollinger Bands indicator allows for the display of Bollinger Bands not only for the chart's timeframe but also overlays longer timeframe Bollinger Bands.

For example, on a 1-hour chart, you can display Bollinger Bands for 4-hour and daily timeframes for enhanced analysis.

By checking the state of the Bollinger Bands for medium to long term, you can mitigate the risk of "missing the forest for the trees" during analysis.

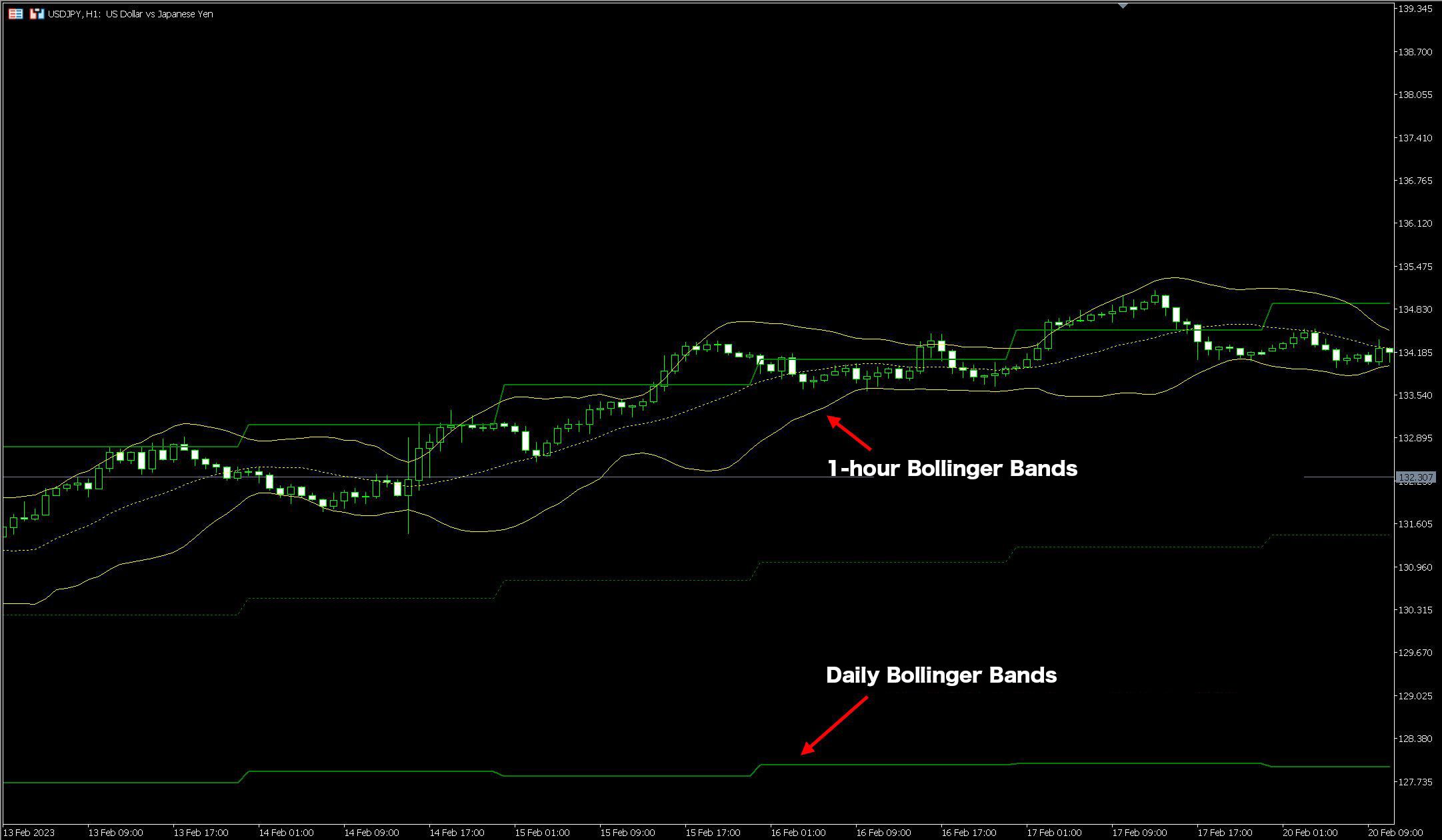

【Example of displaying 1-hour Bollinger Bands (yellow) and daily Bollinger Bands (green) on a 1-hour chart】

Bollinger Bands are indicators that plot lines at a certain number of standard deviations away from a moving average of the price.

The bands provide an analysis based on the probability of price movements remaining within these bands.

The probabilities of the price remaining within the bands are as follows:

Within 1 standard deviation (±1σ): about 68.3%

Within 2 standard deviations (±2σ): about 95.4%

Within 3 standard deviations (±3σ): about 99.7%

【Example of Bollinger Bands displayed with a standard deviation of 2】

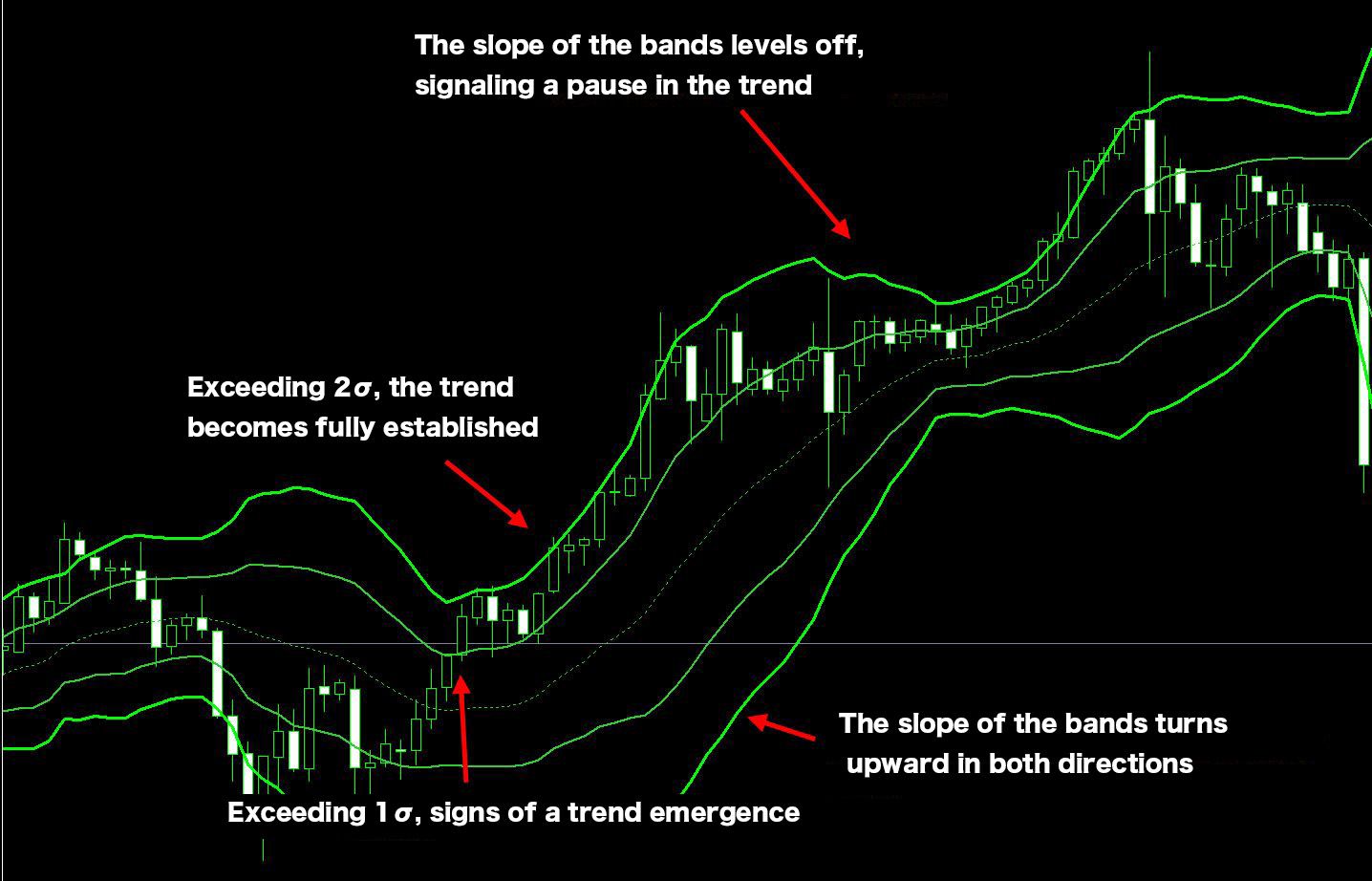

Bollinger Bands can be used to analyze the occurrence of trends.

When the price exceeds the 1 standard deviation band, it indicates a deviation from the moving average, suggesting the start of a trend.

If it exceeds the 2 standard deviation band, it suggests that the trend may be becoming more established.

Moreover, during an uptrend, the bands will angle upwards, and during a downtrend, they will angle downwards. By observing the direction of the bands, one can easily check the direction of the trend.

【Example of trend analysis using Bollinger Bands】

The probability of the price moving within the 2 and 3 standard deviations is 95.4% and 99.7%, respectively.

Therefore, if the price moves beyond 2 standard deviations, it may indicate the beginning of a trend, but it also suggests short-term market overheating.

If it exceeds 3 standard deviations, it is even less probable, indicating a highly overheated market state.

【Analysis of market overheating using Bollinger Bands (using 3 standard deviations)】

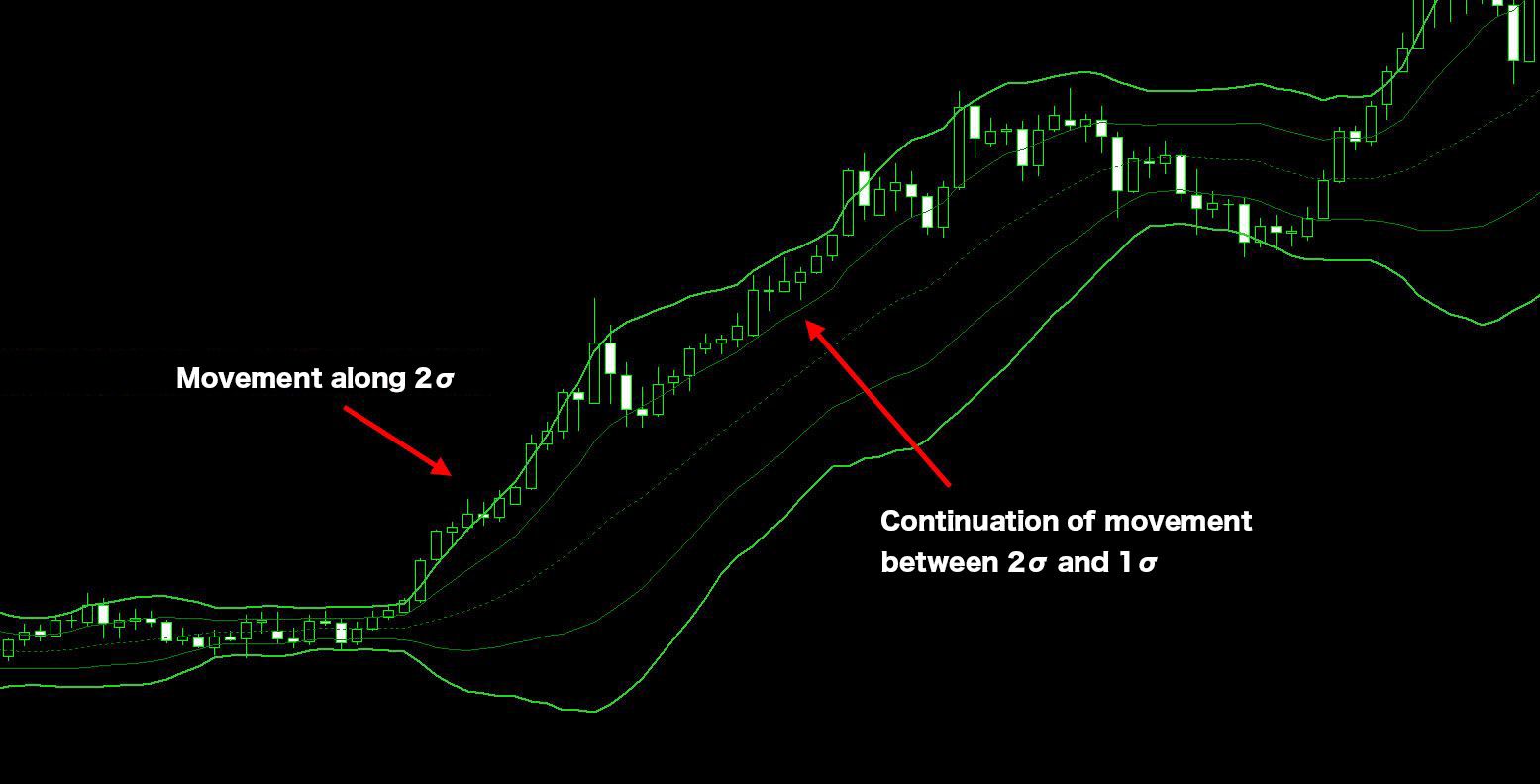

When a trend occurs, the price may continue to move along or between the 1 and 2 standard deviation bands.

This condition is referred to as a "Band Walk" and is indicative of a strong trend state.

【Example of a Band Walk occurrence with Bollinger Bands】

※ This indicator only operates on the Windows version of MT5 and MT4 provided by TitanFX.

| Variable Name | Description | Default |

|---|---|---|

| Timeframe | Specifies which timeframe's Bollinger Bands to display. Selecting 'current' will display the chart's current timeframe. | current |

| Period | Specifies the period for the moving average. | 20 |

| Deviation | Specifies the value for the standard deviation, selectable from 1 to 3. | 2 |

| Shift | Used to shift the display position left or right. Positive integers shift it right, negative integers shift it left. | 0 |

| MA method | Chooses the type of moving average for the center line. Options include Simple (SMA), Exponential (EMA), Smoothed (SMMA), and Linear Weighted (LWMA). | Simple |

| Price field | Specifies the price to be used. | Close price |

| MT5 | MT4 | Description |

|---|---|---|

| Bands MA | 0 | Color, thickness, and type of the center moving average line |

| Bands Upper | 1 | Color, thickness, and type of the upper line |

| Bands Lower | 2 | Color, thickness, and type of the lower line |

Indicator Terms of Use

Only those who agree to all the following items may use the indicators distributed on this website (https://research.titanfx.com):

1.The indicators and related descriptions are based on various data believed to be reliable, but their accuracy and completeness are not guaranteed.

2.The data displayed by the indicators do not guarantee your investment results. Also, the displayed content may vary due to market conditions and communication environments.

3.Please make investment decisions using indicators at your own risk. We are not responsible for any disadvantages or damages arising from the use of indicators.

4.Specifications of the indicators are subject to change without notice. Changes will be announced on the indicator description pages, etc.

5.Indicators should only be used by customers who have downloaded them. Transferring or selling the indicators to third parties is prohibited.