How to use MT5/MT4

The entities below are duly authorised to operate under the Titan FX brand and trademarks. Titan FX Limited (reg. No. 40313) regulated by the Vanuatu Financial Services Commission with its registered office at 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Goliath Trading Limited (licence no. SD138) regulated by the Financial Services Authority of Seychelles with its registered address at IMAD Complex, Office 12, 3rd Floor, Ile Du Port, Mahe, Seychelles. Titan Markets (licence no. GB20026097) regulated by the Financial Services Commission of Mauritius with its registered office at c/o Credentia International Management Ltd, The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. Atlantic Markets Limited (registration no.2080481) regulated by the Financial Services Commission of the British Virgin Islands with its registered address at Trinity Chambers, PO Box 4301, Road Town, Tortola, British Virgin Islands. The Head Office of Titan FX is at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The Titan FX Research Hub purpose is to provide solely informational and educational content to its users, and not investment, legal, financial, tax or any type of personalised advice. Opinions, forecasts, and any other information contained in this website do not constitute recommendations or solicitation to buy or sell financial instruments. Trading leveraged products like CFDs carries high risk and may not suit all investors. Users should conduct independent research or consult qualified professionals before making any trading decisions. While efforts are made to provide accurate information, no warranty is given for the completeness or suitability of the information contained in this website. Reliance on this content is at your own risk and Titan FX accepts no liability for loss or damage. This information is for residents of jurisdictions where Titan FX transactions are permitted.

In global economics, stock indices are critical indicators to measure the overall performance of the stock market. Investors, financial analysts, and general public rely on these indices to capture a real-time view of market trends.

This article will introduce the fundamental concepts of stock indices, including their calculation and their classifications, helping traders understand and utilize the related information better.

The term “Stock Index” is commonly abbreviated as “Index” in news reports, it is a quantitative measure that reflects the performance of a particular stock market or a specific group of stocks within that market. Stocks included in an index are generally referred to as its “constituents.”

Investors can grasp an in-depth understanding of market trends by observing changes in a stock index over time.

Generally speaking, a rising stock index suggests positive market sentiment, or a bull market, while a declining index indicates bear market conditions or a downtrend.

Besides, stock indices are tools that not only vital for market trend evaluation, but also play a role of economic barometers that reflect the health status of specific industries or entire economic conditions.

For instance, the NASDAQ Index is often used to measure the performance of the U.S. technology sector, while the Euro Stoxx 50 Index provides insight into the overall economic landscape of Europe.

Stock indices can be categorized by the selection of their constituents, methods of calculation, and intended uses. Some common classifications are described as follows by the method of calculation.

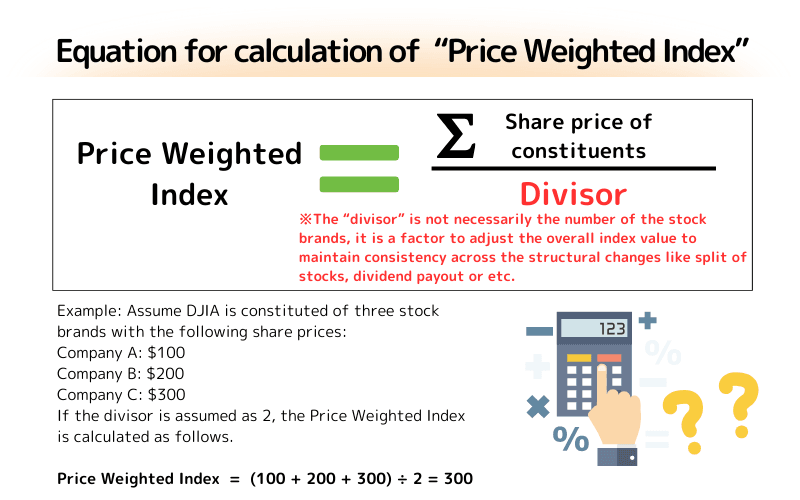

A Price Weighted Index (e.g. Dow Jones Industrial Average, DJIA) adds the prices of all constituents and divides the resulting total by a specific divisor. In this kind of calculation, companies with higher share prices have a greater influence on the index, regardless of their market capitalization.

| Advantage | Disadvantage |

|---|---|

| Simple and intuitive calculation | Stocks with higher prices can disproportionately affect the index, which may lead to poor reflection on the overall market status |

Example: Assume DJIA is constituted of three stock brands with the following share prices:

Company A: $100

Company B: $200

Company C: $300

If the divisor is assumed as 2, the Price Weighted Index will be calculated as follows. Price Weighted Index = (100 + 200 + 300) ÷ 2 = 300

※The “divisor” is not necessarily the number of the stock brands, it is a factor to adjust the overall index value to maintain consistency across the structural changes like the split of stocks, dividend payout, etc.

Assume the index is constituted of three stocks with prices of $100, $200, and $300, and the original divisor is 3, then the initial index value (before adjustment) will be calculated as: Index = (100 + 200 + 300) ÷ 3 = 200

If Company C’s stock is split and its price is reduced from $300 to $150, we will need a new divisor to maintain the index value at 200.

Total Share Price Estimation After Adjustment = 100 + 200 + 150 = 450.

For new divisor calculation, if the requirement is to maintain the Index constant, i.e. at 200, the equation will be as follows.

450 ÷ New Divisor = 200

Solution: New Divisor = 450 ÷ 200 = 2.25

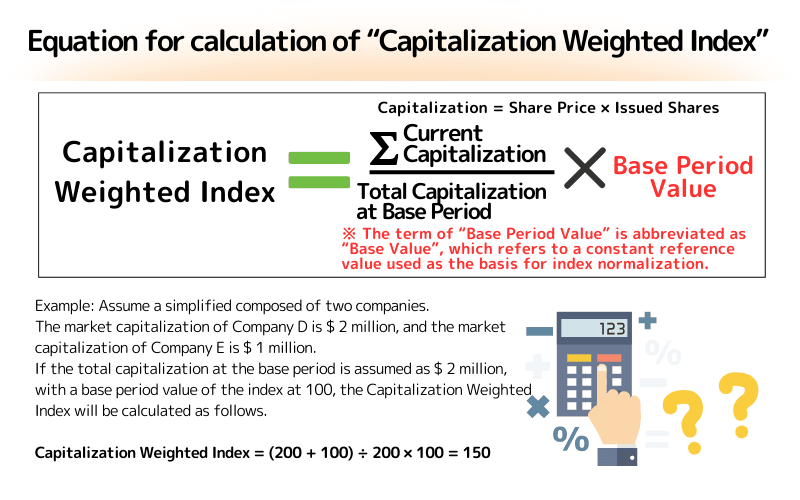

Capitalization Weighted Index (e.g., S&P 500 Index) is calculated according to the weighting assigned by the capitalization of each company, and larger companies will contribute to more influence.

Capitalization = Share Price × Issued Shares

This index is more reflective on companies’ economic impact.

| Advantage | Disadvantage |

|---|---|

| Reflects actual market conditions more accurately, the changes of larger companies have a more significant impact | Major changes in large companies may lead to substantial index volatility |

Example: Assume a simplified market composed of two companies.

The market capitalization of Company D is $ 2 million, and the market capitalization of Company E is $ 1 million.

If the total capitalization at base period is assumed as $ 2 million, with a base period value of the index at 100, the Capitalization Weighted Index will be calculated as follows.

Capitalization Weighted Index = (200 + 100) ÷ 200 × 100 = 150

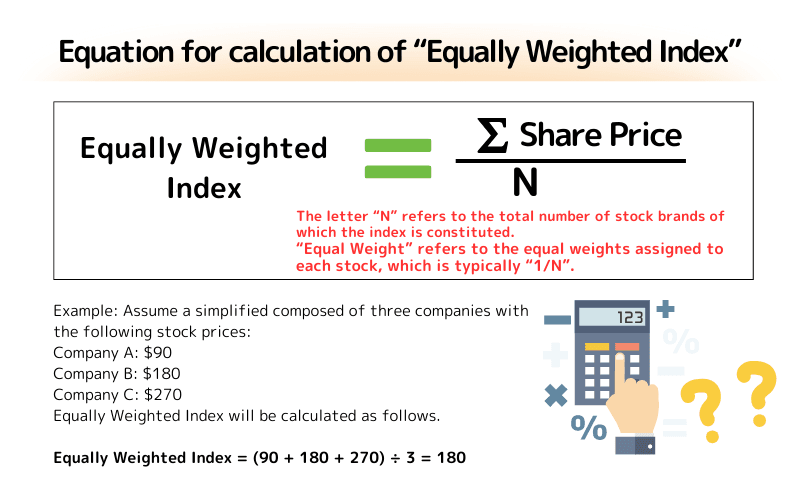

An Equally Weighted Index (e.g., S&P Equal Weight Index) assigns an equal weight to each stock brand, which means that the contribution on the index of each constituent is equal to each other, regardless of market size or price.

| Advantage | Disadvantage |

|---|---|

| Mitigates the disproportionate influence on the index resulting from a single or a few stocks with large capitalization | Requires frequent adjustment of constituents to maintain the status of equal weight |

Example: Assume a simplified composed of three companies with the following stock prices:

Company A: $90

Company B: $180

Company C: $270

Equally Weighted Index will be calculated as follows.

Equally Weighted Index = (90 + 180 + 270) ÷ 3 = 180

Despite the three abovementioned calculation methods, there are methods for calculation utilizing other principles, such as the Fundamental Index that weights stocks according to financial indices of a company like revenue or profit.

| Advantage | Disadvantage |

|---|---|

| May be able to better reflect the economic fundamentals of company | Complex calculations and high requirement on quality and timeliness of the fundamental data |

Major global stock indices cover stock markets worldwide, categorization by geographic region will provide a clearer perspective on them. Some of the major indices by geographic region are as follows.

| Geographic Region | Index Name | Description |

|---|---|---|

| North America | DJIA | Index for the stock prices of 30 major U.S. listed companies |

| North America | S&P 500 | Covers 500 of the largest U.S. listed companies |

| North America | NASDAQ | Covers all companies listed on NASDAQ market, especially the technology companies |

| Europe | FTSE 100 | Top 100 companies listed on the London Stock Exchange |

| Europe | DAX 30 | 30 major companies listed on Frankfurt Stock Exchange |

| Europe | CAC 40 | 40 major companies listed on Paris Stock Exchange |

| Europe | Euro Stoxx 600 | Covers 600 major companies across Europe |

| Asia | Nikkei 225 | 225 major companies listed on Tokyo Stock Exchange |

| Asia | Shanghai Composite | All stocks listed on Shanghai Stock Exchange |

| Asia | Hang Seng Index | Major index for Hong Kong Stock Exchange, covers the largest companies |

| Asia | S&P BSE Sensex | 30 major companies listed on Bombay Stock Exchange, India |

| Oceania | ASX 200 | 200 largest companies listed in Australian Securities Exchange |

| Africa | (FTSE/JSE Top 40) | 40 major companies listed on Johannesburg Stock Exchange, South Africa |

Stock indices are important indicators for understanding the trend of the global market, providing key insights into the performance of investment across regions and industries.

Major global indices, such as the DJIA, S&P 500, NASDAQ Composite, FTSE 100, and Nikkei 225, are the basis for the analysis of the economic status of their respective markets.

These indices, categorized by geographic region, can help investors and analysts view market performance from a geographical perspective, and therefore shape corresponding investment strategies accordingly.

Price Weighted Indices, Capitalization Weighted Indices, and Equally Weighted Indices provide various methods for calculation, reflecting different facets of the market, respectively.

Investors are able to better grasp market trends, optimize portfolios, reduce risks, and explore opportunities for growth through understanding and utilizing these indices.