Concept and Calculation of BIAS: How to Catch the Best Timing for Buy and Sell?

BIAS is a critical technical indicator, it offers traders a unique perspective that helps them to accurately identify market trends and turning points, which therefore improve the analysis on market dynamics and optimize trading decisions.

This article will focus on the calculation, practical applications, and combination of BIAS with other technical indicators to improve the ability of analyzing and forecasting market dynamics.

What is BIAS?

BIAS, also known as deviation ratio, is a technical indicator for financial market analysis which measures the deviation between a specific price (e.g. price of a stock or FX asset) and its average price over a certain interval.

It primarily reflects the relative relationship of the current price and an average over a selected interval, which may help trader identify whether the market is overheated.

Practically speaking, BIAS is calculated by dividing the difference between the current price and the Moving Average Price of a specific interval by the Moving Average Price, usually expressed as a percentage.

A positive BIAS indicates that the current price is higher than the average, suggesting possible market overheating and caution shall be made for potential price corrections.

A negative BIAS suggests that the current price is lower than the average, suggesting a possible undervalued state with potential for a rebound.

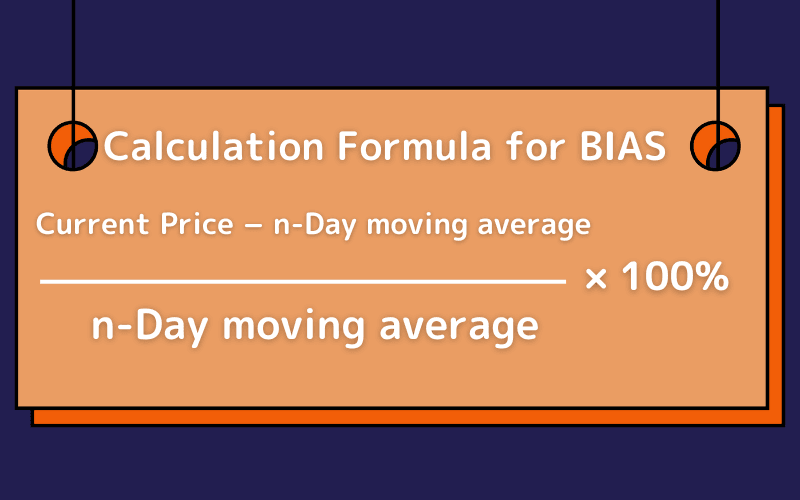

The Calculation of BIAS and Selection of Interval

BIAS = (Current Price - N-day Moving Average) ÷ N-day Moving Average × 100%

Where N-day Moving Average refers to the simple average price over the past N days.

For example, say that the closing prices of a stock over the last five days were 100, 102, 104, 103, and 105, and the current price is 106.

First, calculate the five-day moving average and the result should be 102.8.

Then, substitute it into the BIAS formula, and you should get the BIAS of about 3.11%.

(106 − 102.8) ÷ 102.8 × 100% ≈ 3.11%

In BIAS analysis, you can select the intervals for moving average according to your trading strategies and analytical needs, which varies. Some commonly used intervals for moving average and the corresponding applicable strategies are as follows.

| Trading Strategy | Recommended Interval | Description |

|---|---|---|

| Short-term trading | 5 days, 10 days | Shorter intervals can reflect immediate price changes and market sentiment. |

| Mid-term trading | 20 days, 30 days | Intermediate intervals can provide insights into mid-term market trends and filtering out short-term market noise at the same time. |

| Long-term investing | 60 days, 90 days or longer | Longer intervals are used to assess the long-term trend and relative value of stocks or other assets. |

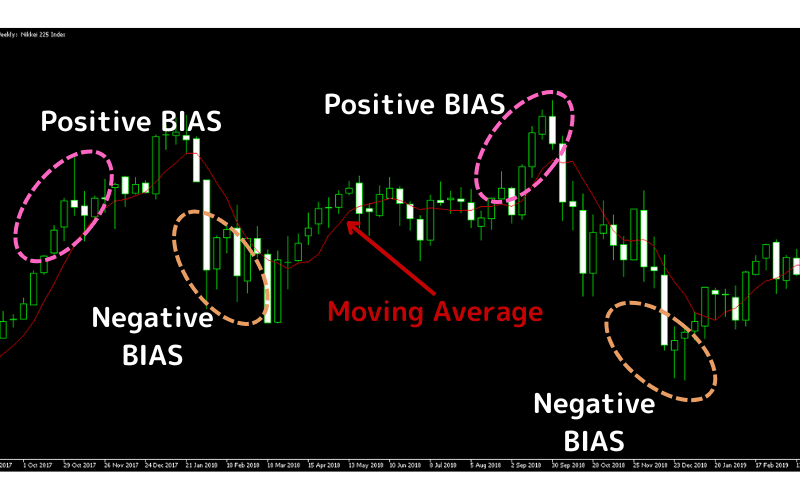

Type of BIAS: Positive and Negative BIAS

Positive BIAS and negative BIAS are used to describe and measure the gap between market price and its moving average, and are often mentioned while analyzing the technical indicator for financial market, BIAS.

| BIAS Type | Definition | Market Interpretation | Tips for Trading Strategy |

|---|---|---|---|

| Positive BIAS | Current price is higher than moving average, the BIAS is positive. | Indicates the potential of overheated market, price may be overvalued. | Positive BIAS is taken as a potential sell signal, indicating possible price correction |

| Negative BIAS | Current price is lower than moving average, the BIAS is negative. | Indicates the potential of cooled market, price may be undervalued. | Positive BIAS is taken as a potential buy signal, indicating possible price rebound |

Actual Use of BIAS

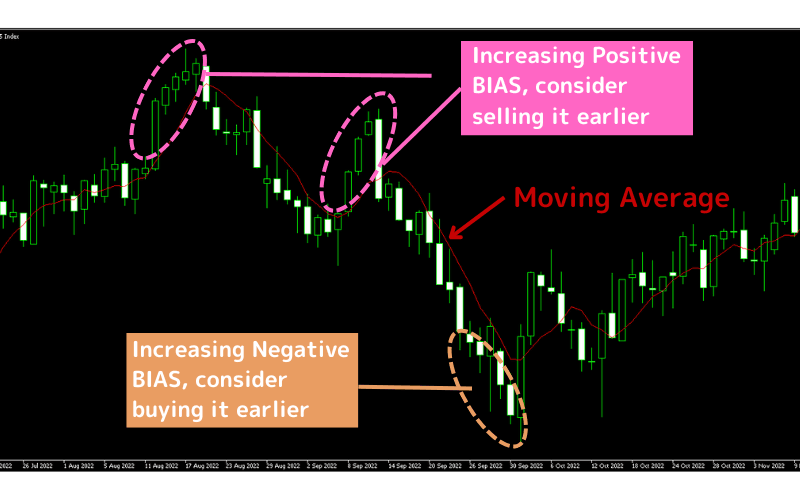

BIAS is an indicator that reflects the relative position of the current price to its moving average and is used to evaluate the conditions of overbought or oversold.

The use of BIAS is based on the concept of “prices tend to restore to their average values, in other words, the moving average often serves as a trend indicator.”

When the price is higher than moving average, it may potentially indicate an overbought market, and a significantly high positive BIAS implies the increase of the likelihood of price correction towards the average, which can be taken as a sell signal.

On the other hand, if the price is lower than moving average and showing a significantly broad negative BIAS, it may potentially indicate an oversold market, with the increasing of potential for rebound, which can be taken as a buy signal.

Why Combine BIAS with Other Indicators?

Rely on BIAS alone may contribute to ambiguous buy/sell signals under certain market conditions, such as slow price increasing/decreasing or consolidation, during which BIAS can only indicate the increase of price reversal.

BIAS is more sensitive to rapid price fluctuations, but it might be less indicative while the amplitude of price changes is small. Therefore, to obtain a more comprehensive and reliable market analysis, it is recommended to combine the use of BIAS with other technical indicators.

BIAS and Bollinger Bands: The combination of BIAS and Bollinger Bands can help to effectively identify potential timing for entry and exit. When using this combination, pay special attention to changes in the width of Bollinger Band, its narrowing may imply the price breakouts about to occur.

BIAS and Stochastic Oscillator (KDJ): For this combination, BIAS helps to determine whether the market is overbought or oversold, while the KDJ indicator is used to evaluate potential upward or downward trends. This combination can not only improve the judgement of trend direction, but also provide clearer trading signals.

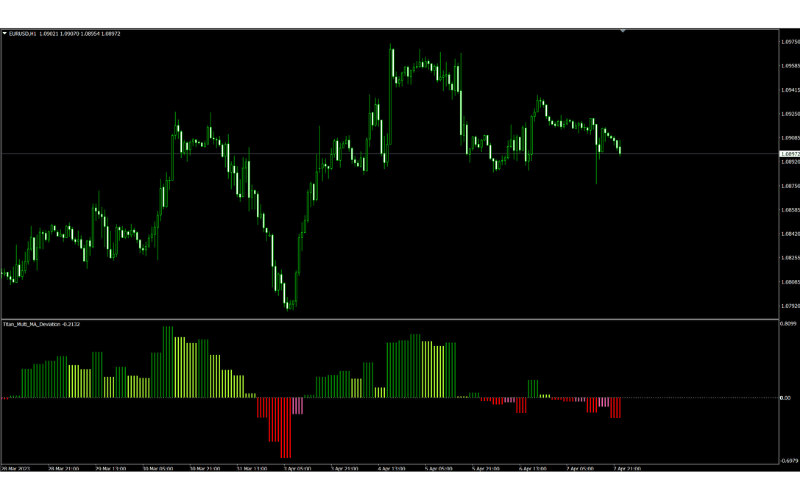

Titan FX Customized Indicator: “Moving Average Deviation (Titan_Multi_MA_Deviation)”

This indicator can display the deviation rate from the moving average line either as a histogram or a line. It can be used in various scenarios to gauge the potential for trend emergence or to detect overheating in the short-term market conditions based on the degree of deviation from the moving average line.

The target moving average line can be based on the chart's timeframe or even longer timeframes than those of the chart.

Additionally, users can choose from four types of moving averages: Simple Moving Average (SMA), Exponential Moving Average (EMA), Smoothed Moving Average (SMMA), and Linear Weighted Moving Average (LWMA). You can display the deviation rate of the moving average type that you prefer.

You can install and use this indicator on MT4 or MT5 once you register for a Titan FX account.

Details for “Moving Average Deviation.”