How to use MT5/MT4

The entities below are duly authorised to operate under the Titan FX brand and trademarks. Titan FX Limited (reg. No. 40313) regulated by the Vanuatu Financial Services Commission with its registered office at 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Goliath Trading Limited (licence no. SD138) regulated by the Financial Services Authority of Seychelles with its registered address at IMAD Complex, Office 12, 3rd Floor, Ile Du Port, Mahe, Seychelles. Titan Markets (licence no. GB20026097) regulated by the Financial Services Commission of Mauritius with its registered office at c/o Credentia International Management Ltd, The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. Atlantic Markets Limited (registration no.2080481) regulated by the Financial Services Commission of the British Virgin Islands with its registered address at Trinity Chambers, PO Box 4301, Road Town, Tortola, British Virgin Islands. The Head Office of Titan FX is at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The Titan FX Research Hub purpose is to provide solely informational and educational content to its users, and not investment, legal, financial, tax or any type of personalised advice. Opinions, forecasts, and any other information contained in this website do not constitute recommendations or solicitation to buy or sell financial instruments. Trading leveraged products like CFDs carries high risk and may not suit all investors. Users should conduct independent research or consult qualified professionals before making any trading decisions. While efforts are made to provide accurate information, no warranty is given for the completeness or suitability of the information contained in this website. Reliance on this content is at your own risk and Titan FX accepts no liability for loss or damage. This information is for residents of jurisdictions where Titan FX transactions are permitted.

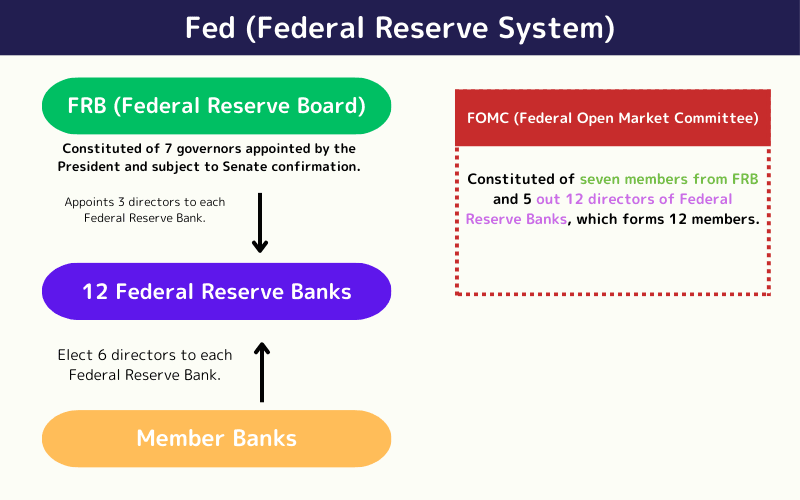

You may have come across the terms “Fed,” “FRB,” and “FOMC” in economic news. Each of these engages with the U.S. central banking system. The term “Fed” refers to the central banking system itself, “FRB” is the board that operates the Fed, and the “FOMC” is a committee held by FRB.

Let’s explore the definitions of the “Fed,” “FRB,” and “FOMC,” their relationships, and key investment implications of them.

The term Fed is the abbreviation for the Federal Reserve System, which is the general term for the central banking system of the United States, commonly referred to as “the Fed,” it includes the Federal Reserve Board (FRB) and the Federal Open Market Committee (FOMC).

The term FRB is the abbreviation of the Federal Reserve Board.

The FRB decides various financial policies of the United States together with the 12 regional Federal Reserve Banks.

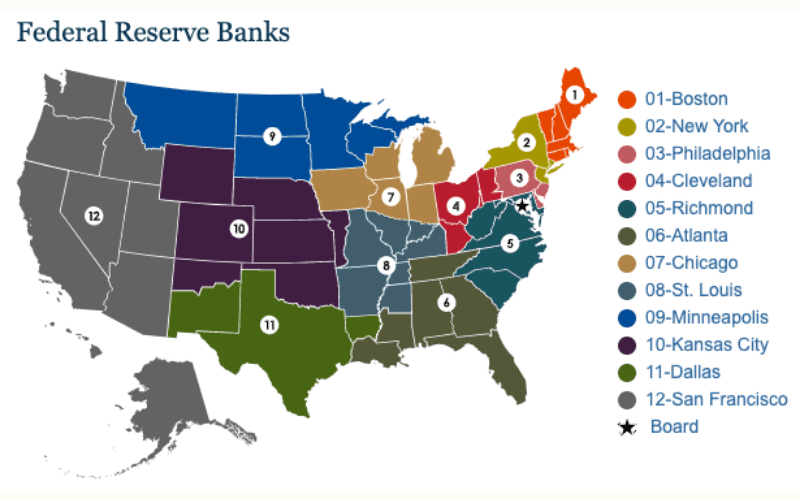

Unlike the central banks in countries like Japan, the UK, Singapore, China, and Taiwan, which operate as single institutions, the U.S. central bank is a collective consisting of 12 regional banks, collectively known as the FRB.

These 12 banks are located in the following regions.

| Reserve District | Federal Reserve Bank |

|---|---|

| 1st Federal Reserve District | Federal Reserve Bank of Boston |

| 2nd Federal Reserve District | Federal Reserve Bank of New York |

| 3rd Federal Reserve District | Federal Reserve Bank of Philadelphia |

| 4th Federal Reserve District | Federal Reserve Bank of Cleveland |

| 5th Federal Reserve District | Federal Reserve Bank of Richmond |

| 6th Federal Reserve District | Federal Reserve Bank of Atlanta |

| 7th Federal Reserve District | Federal Reserve Bank of Chicago |

| 8th Federal Reserve District | Federal Reserve Bank of St. Louis |

| 9th Federal Reserve District | Federal Reserve Bank of Minneapolis |

| 10th Federal Reserve District | Federal Reserve Bank of Kansas City |

| 11th Federal Reserve District | Federal Reserve Bank of Dallas |

| 12th Federal Reserve District | Federal Reserve Bank of San Francisco |

The term FOMC, is the abbreviation of the Federal Open Market Committee, refers to the committee within the FRB holding regular meetings.

The meeting is attended by the FRB board members and five of the presidents of regional Federal Reserve Banks.

The FOMC meets eight times a year to discuss mainly about the economic goals like interest rate.

The responsibilities of FRB are to achieve the dual mandate of “maximum sustainable employment” and “price stability” through various financial policies.

The FRB decides if and how to adjust the policy rate, whether by raising or lowering it, and sets target rates accordingly.

The rate adjusted by FRB is the federal funds rate (FF rate). In the U.S., commercial banks are required to deposit federal funds (reserve deposits) into the Federal Reserve Banks.

While these federal funds do not accrue interest, the rate at which banks lend to each other is known as the FF rate. When the FRB “raises rates,” it refers to the increase of the target level for the FF rate.

How does RB as a central bank raise the lending rates among commercial banks? Since the FRB cannot dictate exact lending rates among commercial banks, it indirectly guides the FF rate by adjusting the currency in circulation in the market.

As mentioned before, the FRB decides whether to adjust the policy rate (whether to raise or lower rates) and the actual target rate level for adjustment.

These decisions are made in FOMC meetings, where market attention focuses on four key aspects:

1: Statement

2: FRB Chair’s Press Conference

3: The Summary of Economic Projections by FOMC Members

4: Meeting Minutes

After the end of the FOMC meeting, a statement is released that summarizes the overview of the evaluation of economic conditions and commodity prices, and basic decisions such as whether to adjust financial policies.

Thirty minutes after the release of the statement, the FRB Chair holds a press conference to elaborate on the decisions made during the meeting, comment on trends of economic conditions and commodity prices, and then answer questions from the reporters.

These sessions may ignite significant market reactions, and thus require close attention.

FOMC releases the Economic Projections provided by FOMC members quarterly (in March, June, September, and December), covering their projection on policy rates, actual GDP, unemployment rates, and PCE inflation and core PCE inflation for the next three years.

Every projection data is important, but the most focused projection is that of policy rate.

About three weeks after the FOMC meeting, Meeting Minutes are released, offering additional discussion which is not revealed in the statement and press conference.

The FRB Chair, Vice Chair, Governors, and presidents of regional Federal Reserve Banks often comment on various lectures, press releases, and workshops, as an FOMC member.

The comments by FOMC members are always closely watched, but while the market is highly focused on U.S. financial policies, these comments will be more sensitive.

| Abbreviation | Full Term | Chinese Translation | Description |

|---|---|---|---|

| FED | Federal Reserve System | 聯邦準備系統 | The central banking system |

| FRB | Federal Reserve Board | 聯邦準備理事會 | The central bank |

| FOMC | Federal Open Market Committee | 聯邦公開市場委員會 | Committee within the FRB |